|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 25 Year Refinance Rates: A Comprehensive GuideRefinancing your home can be a strategic financial move, especially when considering a 25-year refinance rate. This option balances the benefits of shorter and longer loan terms, providing a unique opportunity for homeowners. What Are 25 Year Refinance Rates?25 year refinance rates refer to the interest rates applicable when a homeowner refinances their mortgage over a 25-year term. This option is often chosen by those looking to lower their monthly payments while also paying off their mortgage sooner than a traditional 30-year term. Benefits of Choosing a 25 Year Term

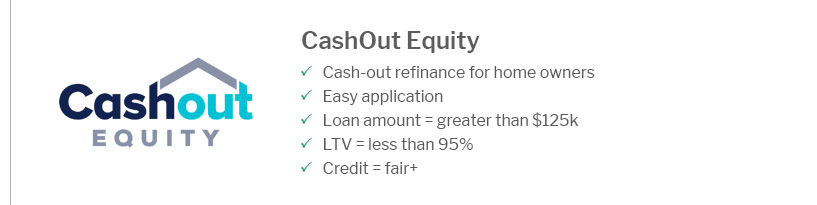

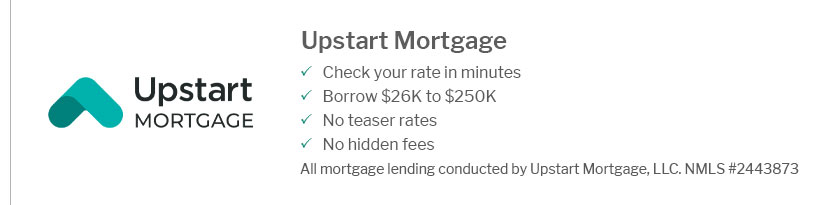

How to Qualify for 25 Year Refinance RatesTo qualify for the best 25 year refinance rates, lenders typically consider several factors, including your credit score, debt-to-income ratio, and the amount of equity in your home. Working with reputable home financing companies near me can help streamline the process. Improving Your Chances

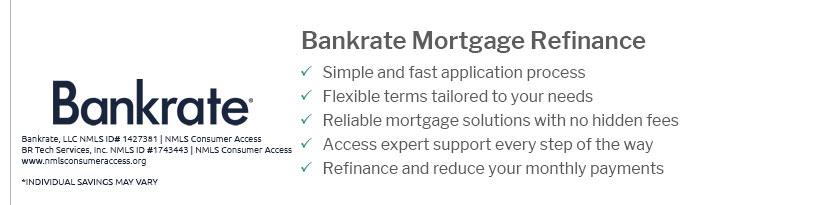

Comparing 25 Year Rates with Other TermsWhile 25 year refinance rates offer a middle ground, it’s essential to compare them with other options like 15-year or 30-year terms. You can use resources like house lending interest rates to evaluate current market trends. Key Differences

FAQsWhat is the typical interest rate for a 25-year refinance?The interest rate for a 25-year refinance varies based on market conditions, credit score, and lender. As of the latest data, rates can range from 3% to 5%. Is a 25-year refinance a good idea?A 25-year refinance can be beneficial for those looking to lower monthly payments while reducing the total interest paid compared to a 30-year mortgage. It offers a balanced repayment period and can be a smart financial decision based on individual circumstances. Can I switch from a 30-year to a 25-year mortgage?Yes, refinancing allows you to change your loan term from 30 years to 25 years, potentially lowering your interest rate and the total interest paid over the life of the loan. https://www.rocketmortgage.com/refinance-rates

25%) roughly equals a $30 difference in your monthly payment. Your Rate Is Unique. Your loan amount, your credit profile, ... https://www.zillow.com/refinance/

The current national average 5-year ARM refinance rate is equal to 7.12%. Last updated: Tuesday, March 25, 2025. See legal disclosures. Refinance rate trends. https://www.zillow.com/refinance/

The current national average 5-year ARM refinance rate is equal to 7.12%. Last updated: Tuesday, March 25, 2025. See legal disclosures. Refinance rate trends.

|

|---|